While global financial markets are reeling from the latest geopolitical events in Eastern Europe, earnings season for Q4 2021 is quietly drawing to a close, with over 90% of companies in the S&P 500 having already reported. The preliminary results, which at this point are unlikely to change much, show earnings 29% higher than the same quarter a year ago, which is almost 6% higher than analysts were expecting. From a sector perspective, late cyclicals such as Energy (N.M.[1]), Industrials (102.9%) and Materials (56.8%) contributed the most to the 2021 earnings surge, staging an impressive rebound after a disappointing 2020. Meanwhile, defensive sectors such as Utilities (7.1%) and Consumer Staples (6.2%) lagged behind. Going forward, analysts expect the earnings expansion to last for at least another two years, with S&P 500 earnings per share growing from $208 in 2021 to $225 in 2022 and $248 in 2023. This implies a slower but much more sustainable growth rate of around 9% per year.

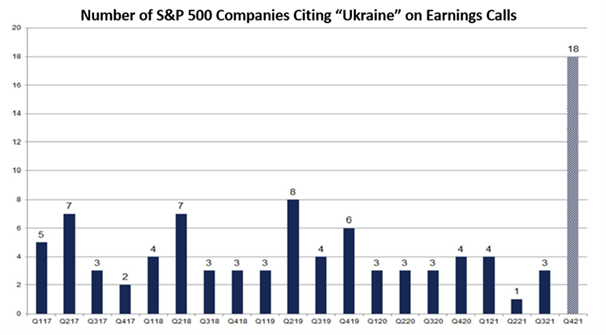

As terrible as the events currently unfolding in Ukraine are from a humanitarian perspective, they are unlikely to affect the earnings outlook for the S&P 500 in a meaningful way. First of all, Russia and Ukraine are two very small players in the global economy. Based on 2020 GDP numbers provided by the World Bank, Russia contributes 1.75% to global GDP while Ukraine contributes only 0.2%. As such, even a severe and prolonged economic recession in these two countries would barely put a dent on global GDP, which is expected to grow by 4.1% in 2022. The impact for S&P 500 companies may turn out to be even smaller given the relatively limited ties between the US and the two Eastern European economies. Out of the 462 companies of the S&P 500 that have reported Q4 2021 earnings so far, as many as 18 have mentioned Ukraine on their earnings call. While that is the highest number since the peak of 40 in Q1 2014, it still amounts to less than 4% of companies in the index. By contrast, 72% of S&P 500 companies have cited inflation on earnings calls over this same period. The relatively small number of S&P 500 companies mentioning Ukraine is explained by the limited revenue exposure of these companies to Russia and Ukraine. According to FactSet, the combined revenue exposure of S&P 500 companies to Russia and Ukraine amounts to about 1%. Consumer Staples is the S&P 500 sector with the most exposure, with about 1.5% of the sector’s revenue last year coming from Russia. For most S&P 500 sectors, exposure to Russia and Ukraine is negligible.

[1] Earnings growth not measurable due to earnings being negative for this sector in 2020. Sales for the Energy sector grew 91.5% in 2021

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.