We talk a lot about breadth because ‘participation’ to the upside is vital for a sustained move higher. We want to see the majority of troops following the general!

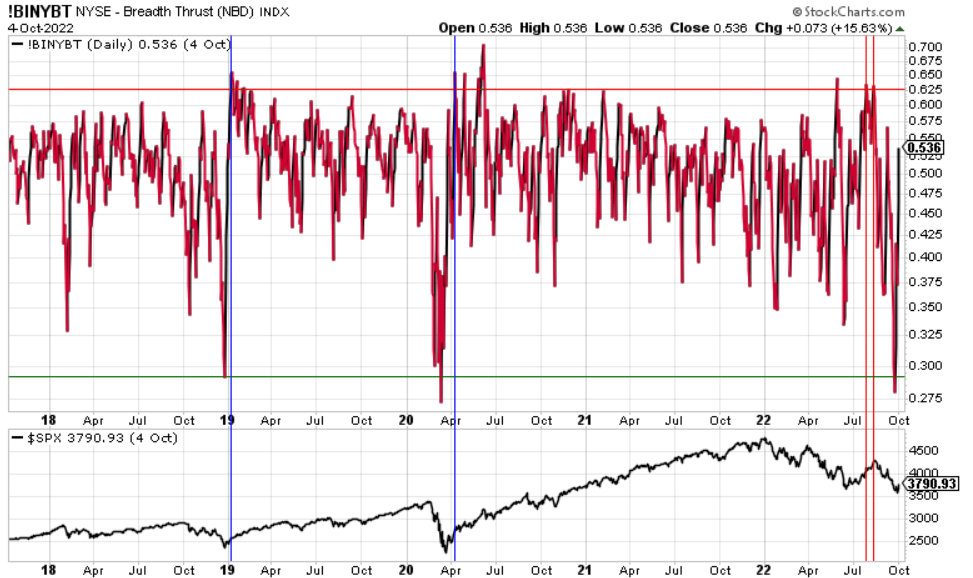

Additionally, the start of new bull markets are marked by breadth thrusts. These thrusts are indications that the market has moved from oversold to one of strength. The chart below is one such indicator developed by Marty Zweig which measures the 10 day moving average of stocks advancing versus stocks declining. When the indicator goes from a very low number, usually below 40, to a very high number, usually above 63, this indicates the start of a new bull market. The blue lines on the chart show just how well this worked in 2019 and 2020 as breadth went rapidly from 30 to 65 at the beginning of those advances.

A few months ago we were discussing the possibility of a new bull market as once again we saw breadth thrusts above 63. These thrusts occurred in July and are marked by the red lines. In retrospect, maybe the market wasn’t ‘oversold’ enough to sustain a new bull market; or better said we did not see true capitulation. However, over the last few weeks we may have seen just that as the indicator printed a below 30 reading consistent with readings at the bottom of the 2018 and 2020 bear markets.

A lot has been printed today about the great rally on Monday and Tuesday, and we agree it’s a great start. But we want to see another thrust register to have more confidence this isn’t another bear market bounce.

Sean Dillon, CMT, CFTe

SVP, Investment Strategies

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.