I have four predictions for 2022 – here goes:

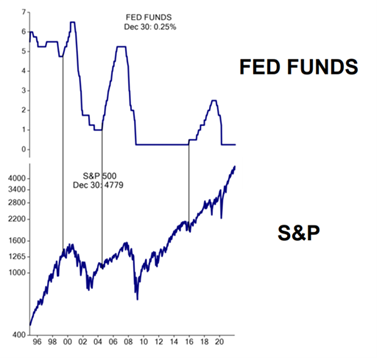

- The Fed is going to raise interest rates. Maybe the most meaningless prediction in the history of prediction because the Fed has already telegraphed their desire to start hiking rates and the bond and stock market have already priced it in. The good news is the chart below (See page 2). History says the equity market can and does continue to do well even when the Fed starts hiking rates. Don’t fear the beginning of a Fed rate hiking cycle – fear rate hikes 4,5,6,7 etc. and especially fear when the shape of the yield curve inverts (2y rates > 10y rates). That phenomenon (an inverted yield curve) slows economic growth, slows earnings growth, and ultimately slows the economy into a recession. It’ll takes years, not months and certainly not weeks, to develop.

- The record money supply growth of the past two years will lead to very, very strong economic growth in 2022 and beyond. Money supply growth LEADS economic growth. M2 money supply +41% in the past two years. FORTY ONE PERCENT. After record money supply growth in 2021 we are just getting started on economic growth. Labor better, wages better, housing better…basically better will be better.

- Economic growth will drive the most important thing of all: corporate earnings growth. EDSP. Earnings drive stock prices. I think earnings on the S&P500 coming out of late FY22 will be running about $250/sh ANNUALIZED. That’s about +20% from where we are today. I think some of that has already been priced into stocks, but not all of it. We are in an earnings bull market which is driving a stock market bull market.

- Volatility returns. We’re so overdue for some extended volatility that it seems like an easy prediction to make. Equity markets can and do go down even in bull markets. 5-10% corrections happen ALL THE TIME. Let’s all reset expectations accordingly. The list of what we collectively all don’t know, don’t expect, and never saw coming goes for miles and miles. Like always, we live in a world in which there are a plentitude of unknowns. Asset allocation is everything. Own quality and be diversified. It’s a very boring strategy that works very well over time.

The art of prophecy is very difficult, especially about the future.

Mark Twain

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.