This morning brought the latest read on inflation with the release of the Consumer Price Index (CPI) for March. Overall, it was mostly in-line with expectations with further signs of disinflation, and a potentially significant development looking ahead. The good news is that the headline CPI slowed to 5%, down from a peak of 9.2% last June and at the slowest pace since May 2021. Food, energy (particularly natural gas), and used cars & trucks were among the categories that declined the most last month, according to the Bureau of Labor Statistics. More troubling was that core inflation (ex-food & energy) increased slightly to 5.6%, with some service-related components continuing to look “sticky.”

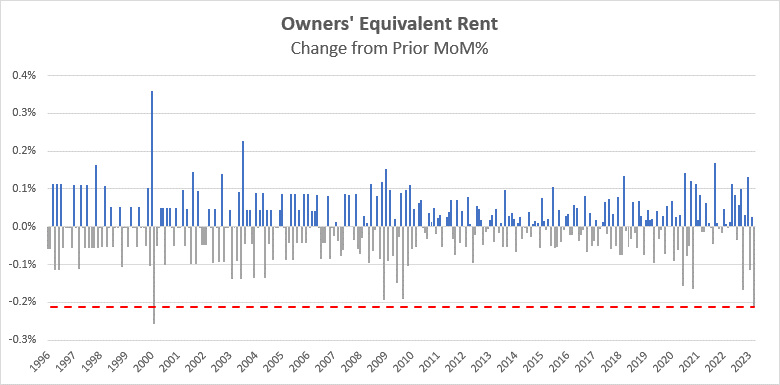

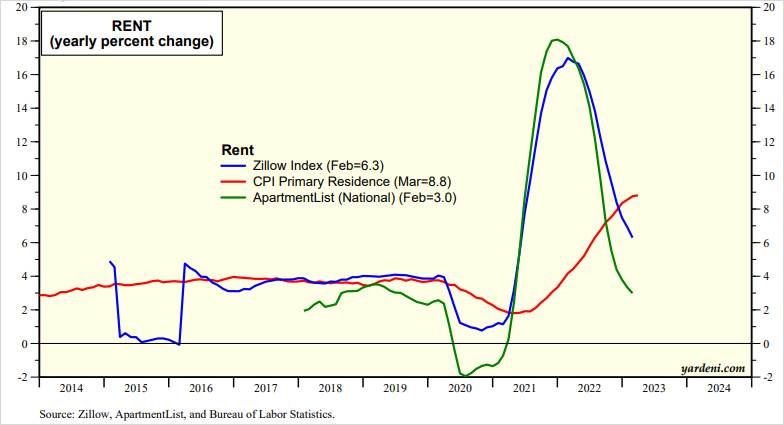

Within core inflation, the big problem area has been shelter, which moves on a lag and has continued to rise despite other signs that housing and rental costs are cooling. So-called Owners’ Equivalent Rent (OER) is still increasing at an 8% rate year-over-year, but on a monthly basis slowed from 0.7% to 0.48%. That may not seem like much but it’s actually the biggest monthly decrease since February 2000. With private estimates having peaked some time ago and continuing to point lower, if this proves to be the initial crack in official shelter inflation then it would be an important and necessary development to help bring overall inflation back down to the Fed’s longer-term 2% target.

It should also provide cover for the Fed to pause hiking rates – soon. Right now, the market places the odds of another quarter-point hike at the next FOMC meeting in May at about 75%, but then only a 5% chance of another hike at the following meeting in mid-June. In other words, a pause finally appears to be on the horizon by early summer.

Sources: Bloomberg, Yardeni Research as of 4/12/23

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.